Introduction

Understanding Bitcoin

Bitcoin, the first decentralized cryptocurrency, was introduced in 2009. It operates on a blockchain, a public ledger that records all transactions across a network of computers. Bitcoin's value is derived from its scarcity, as there is a fixed supply of 21 million coins. This scarcity, combined with its decentralized nature, has made Bitcoin a popular investment choice.

Challenges in Bitcoin Pricing

Despite its popularity, accurately pricing Bitcoin remains a challenge. The cryptocurrency market is influenced by various factors, including technological advancements, regulatory changes, market sentiment, and macroeconomic conditions. These factors make it difficult to establish a precise valuation for Bitcoin.

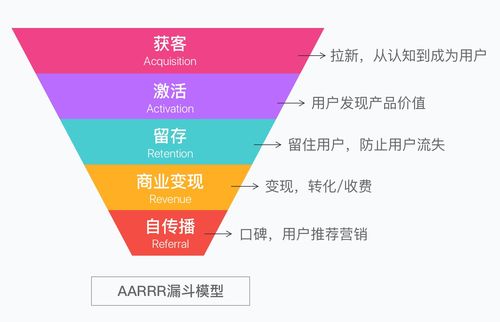

Market Data Analysis: Collecting and analyzing historical price data, transaction volumes, and market sentiment.

Technical Analysis: Utilizing various technical indicators and chart patterns to identify trends and potential price movements.

Fundamental Analysis: Evaluating the underlying factors that influence Bitcoin's value, such as technological advancements, regulatory news, and macroeconomic indicators.

Market Data Analysis

Technical Analysis

Technical analysis involves the use of various tools and indicators to analyze historical price data and identify potential price movements. Common technical indicators include moving averages, RSI (Relative Strength Index), and Bollinger Bands. By applying these tools, we can gain insights into the current market conditions and make more accurate predictions.

Fundamental Analysis

Fundamental analysis focuses on the underlying factors that influence Bitcoin's value. This includes evaluating technological advancements, regulatory news, and macroeconomic indicators. For instance, the development of new blockchain technologies or changes in government policies can significantly impact Bitcoin's price.

Machine Learning Algorithms

Conclusion

Tags