Understanding Bitcoin Short Selling and Long Selling

Introduction

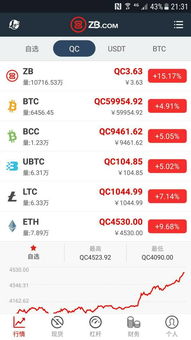

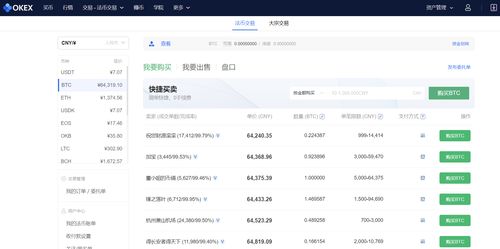

Bitcoin, as the world's first decentralized cryptocurrency, has gained significant attention from investors and traders. With its volatile nature, Bitcoin trading has become a popular way to make profits. Two common trading strategies in Bitcoin are short selling and long selling. In this article, we will explore what these strategies mean and how they can be implemented.

What is Bitcoin Short Selling?

Definition

Bitcoin short selling is a trading strategy where an investor expects the price of Bitcoin to decrease. The investor borrows Bitcoin from a broker and sells it at the current market price, hoping to buy it back at a lower price in the future and return it to the broker, thereby making a profit from the price difference.

Process

1. Borrowing Bitcoin: The investor borrows a certain amount of Bitcoin from a broker.

2. Selling Bitcoin: The investor sells the borrowed Bitcoin at the current market price.

3. Waiting for Price drop: The investor waits for the price of Bitcoin to decrease.

4. Buying Back Bitcoin: Once the price of Bitcoin falls, the investor buys it back at the lower price.

5. Returning Bitcoin: The investor returns the borrowed Bitcoin to the broker, making a profit from the price difference.

Risks

Bitcoin short selling carries significant risks, as the price of Bitcoin can skyrocket unexpectedly. If the price of Bitcoin increases instead of decreasing, the investor may face substantial losses.

What is Bitcoin Long Selling?

Definition

Bitcoin long selling, also known as buying, is a trading strategy where an investor expects the price of Bitcoin to increase. The investor buys Bitcoin at the current market price, hoping to sell it at a higher price in the future and make a profit from the price difference.

Process

1. Buying Bitcoin: The investor buys a certain amount of Bitcoin at the current market price.

2. Waiting for Price Increase: The investor waits for the price of Bitcoin to increase.

3. Selling Bitcoin: Once the price of Bitcoin rises, the investor sells it at the higher price.

4. Making a Profit: The investor makes a profit from the price difference.

Risks

Bitcoin long selling also carries risks, as the price of Bitcoin can plummet unexpectedly. If the price of Bitcoin decreases instead of increasing, the investor may face losses.

Choosing the Right Strategy

When deciding between Bitcoin short selling and long selling, investors should consider several factors:

1. Market Analysis: Investors should analyze the market trends and factors that may affect the price of Bitcoin.

2. Risk Tolerance: Investors should assess their risk tolerance and choose a strategy that aligns with their risk appetite.

3. Investment Goals: Investors should define their investment goals and select a strategy that aligns with those goals.

Conclusion

Bitcoin short selling and long selling are two popular trading strategies that can be used to make profits from the volatile nature of Bitcoin. However, both strategies carry risks, and investors should carefully consider their market analysis, risk tolerance, and investment goals before choosing a strategy. By understanding the processes and risks associated with these strategies, investors can make informed decisions and potentially achieve their investment goals.

Tags: Bitcoin, ShortSelling, LongSelling, TradingStrategies, Cryptocurrency, Investing